December 5, 2019 - By: Brandon Jenkins

A friend of mine asked me to review some old, whole life insurance policies he had established a while back.

They are dividend paying policies, payable until age 100, with a reputable, fraternal insurance company.

Just like other whole life insurance policies, the cash value is guaranteed to grow at a minimum, predetermined rate, and the death benefit is guaranteed to be paid as long as the premiums are paid and the policy does not lapse. Both the cash value and death benefit will grow even more when dividends are received and used to purchase paid-up additions.

This is all good news. These particular policies have been in force long enough that the accumulated cash values will exceed the total premium paid into the policies in the next two years or so-one policy is 15 years old, and the other is 18.

So, what makes a policy like the two described above different than the high cash value whole life policies we specialize in designing at Tier One?

Life insurance has significant tax benefits under the current tax code, including:

- Death benefit passes income-tax free to beneficiaries

- Cash value enjoys uninterrupted, tax-deferred, compound growth

- Paid-up addition surrenders of cash value are tax-free until basis is reached

- Policy loans can be taken against the cash value, tax free

In order to realize these tax benefits, a policy must conform to the IRS rules. A policy that has too much cash value relative to the amount of death benefit will be deemed a modified endowment contract (MEC), and no longer considered life insurance for the purposes of tax treatment.

The insurance company uses a test to determine how much premium can be paid into a policy without turning it into a MEC. This results in a range of potential premiums that could be paid into a policy with a given level of death benefit from the minimum amount required to sustain that death benefit, all the way up to the MEC limit.

By paying as much premium as possible up to the MEC limit while keeping the death benefit as low as possible, the policyowner maximizes the amount of cash value up front that can go into the policy.

This is appealing to those wanting a safe place to store cash that will earn far more than traditional checking, savings, or money market accounts. Cash value inside of a whole life insurance policy is not subject to stock market volatility, and can always be leveraged via policy loans. Once a policy loan is taken, the cash value continues to grow while the money from the loan can be used for anything the policyowner wants. Money is doing multiple things at once, which is a powerful principle of sound financial strategy.

So, what would a policy designed for high cash value growth early on look like compared to an ordinary policy?

There are a number of ways to design a policy, and the ultimate decision will be based on your unique situation and financial objectives. There is no one-size-fits-all approach, so talk to an advisor who specializes in integrating this type of policy into your overall financial strategy before making a final decision.

To keep things simple for this article, we will focus on three specific elements to look for in a policy illustration that indicate the policy is designed for early, high cash value accumulation:

- Term Rider (may or may not be required)

- Paid-Up Additions Rider (PUAR)

- 7-Pay Premium (to indicate the MEC limit for the policy)

The presence of the term rider for this type of policy is to increase the death benefit, and therefore the MEC limit, to a level that will enable the policyowner to contribute a higher lump sum premium up front.

This is useful for someone who wants to move a significant amount of money from another asset into a whole life policy but does not want or is unable to continue paying that much premium on an ongoing basis.

The PUAR is what supercharges the policy cash values early on. Premiums that are paid into this rider purchase paid-up additions (PUA). Think of PUA’s as small chunks of fully paid for death benefit and corresponding cash value. Almost every dollar put into a PUAR is immediately available as cash value.

The 7-Pay Premium is where you look to see the maximum amount of premium that could be paid into the policy without making it a MEC. This is the MEC limit. While your premiums might not be at the MEC limit, they should be close if your desire is to maximize cash value early on and minimize the death benefit.

You will see all these elements in the following example.

This 40 year old male wants to pay $12,000 per year into a high cash value policy and pay an additional $20,000 into the policy up front for a total of $32,000 of premium the first year.

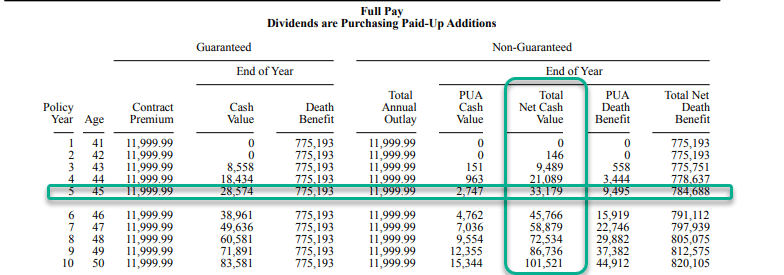

The first figure shows an ordinary policy. Premiums are $12,000 per year, payable to age 100, and the corresponding death benefit is $775,193. The MEC limit, as indicated by the 7-Pay Premium, on this policy is $31,603.51.

In this policy, note how long it takes for cash value to accumulate. In year five, at current dividend scales, the cash value would be $33,179.

Notice, this does not accomplish our client’s goal of paying a total of $32,000 into the policy the first year. Even though the 7-Pay Premium may allow it, an ordinary policy without the appropriate rider, the PUAR, sets a level premium for the life of the policy. There is no way to pay more into this policy.

To accomplish this goal, let’s see what the policy looks like with a PUAR. Take a look below. The ongoing premium is still $12,000, but the initial death benefit is higher at $851,147 thanks to the PUAR contribution.

The extra death benefit also increases the MEC limit to $34,584.42 which allows this extra premium to go into the policy.

The new cash values look better earlier on. The first year, $19,177 is available, and in year five, $55,855 is available at current dividend scales. The extra cash value is due to the PUAR contribution.

The power of the PUAR is starting to become clear thanks to this example. However, the ongoing premium of $12,000 is still comprised of 100% base premium and does not consist of any PUAR contributions.

Let’s wrap this up by making the majority of the $12,000 ongoing premium, paid-up additions. By doing that, the base death benefit will be lower, so we will add a term rider to keep the death benefit high enough to allow us to add the $20,000 initial contribution. Now, look how this policy has changed.

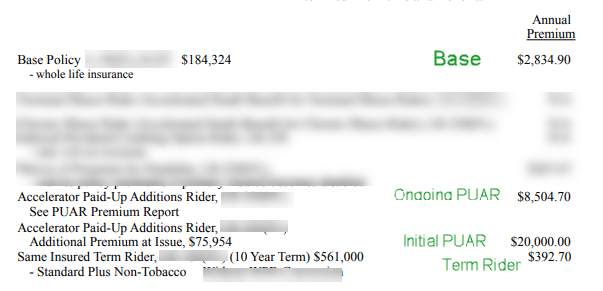

Ongoing premium is $12,000 with an extra $20,000 added the first year, and the initial death benefit is $853,576, only slightly higher than the example above.

Here are the elements that make this policy different. One, the base policy death benefit is only $184,324. That is not high enough to allow for the extra $20,000 contribution without making the policy a MEC. So, a 10-year term policy with a $561,000 death benefit is added. See below for the ongoing breakdown of premium. Of the $12,000, only $2,834.90 goes to base premium, whereas $8,504.70 is going towards PUAR contributions. Next, you will see how the cash values are affected.

At current dividends, the cash value at the end of year five would be $75,357, almost $20,000 more than the previous example, and $27,332 or more than 85% of the first year’s premium is available as cash value. Something else to note here is the decrease in death benefit in year eight after the term rider has been dropped since it is no longer needed to prevent the policy from becoming a MEC.

By the end of year seven, the premiums in this policy have been fully recouped as indicated by the cash value being higher than total contributions.

Here is a look at the five year cash values of each of the three examples above combined:

By structuring the ongoing premium this way, more cash value is available early on for other opportunities, making this a compelling alternative for storing cash reserves.

It is important to remember that the examples above are generic in nature and do not take into account your personal financial situation. Speak with an advisor who specializes in designing these policies and integrating them into your overall financial strategy to ensure your objectives are met.