April 15, 2022 - By: Brandon Jenkins

As with most financial questions, the answer to this one is, it depends.

Each military retiree’s situation is different. SBP can be especially beneficial for those who find themselves otherwise uninsurable. For those who are in good health, a life insurance alternative may be the answer.

It is important to review your post-military retirement goals and personal financial strategy. Speaking to a financial professional can help clarify these topics. Think of SBP as another tool available to help you achieve your objectives. It might be the right tool for you, or it might not be, but it should be integrated into a comprehensive financial strategy.

Okay, so what is SBP?

When a military service member retires after 20 or more years of service, he or she receives a pension for life. That pension is a percentage of the highest three years (high-three) of base pay the military member earned during his or her career and is adjusted for inflation each year.

A retiree could expect to be paid a pension for well over 30 years. For some, the military pension becomes the most significant portion of ongoing income for the retiree and family.

If the retiree passes away, pension payments will stop with nothing continuing to be paid to the deceased’s dependents. Without proper planning, this could be devastating for surviving family members.

SBP, a fixed annuity providing monthly income with cost-of-living increases, is intended to help solve this issue. By enrolling in the program, a portion of the service member’s pension will continue to be paid to a surviving beneficiary. More details below: 1

- Premiums: Up to 6.5% of gross retirement pay plus an additional child cost (more for the insurable interest option). After 360 months and age 70, no more premiums are due

- Benefit: Maximum of 55% of service member’s retirement pay (can be lower and tailored to your needs)

- Taxation:

- Premiums are paid before tax

- Benefits are taxed as income when received

- Enrollment period: At retirement. If married at retirement and enrollment is declined, the spouse and any future spouse if the retiree divorces or is widowed will not be able to enroll. Additional enrollment periods have occurred in the past, but are not guaranteed. If unmarried at retirement and the retiree later marries, he or she will have the ability to enroll at that time.

- Beneficiary options:

- Spouse only

- Spouse and child

- Child only

- Former spouse

- Former spouse and child

- Insurable interest

- Decline participation

Reservists have different rules and increased costs, but are able to participate in the Reserve Component Survivor Benefit Plan (RCSBP). 2

Also, premium pay periods may change depending on your disability rating from Veterans Affairs (VA).

Now that I know what SBP is, how do I know whether or not to decline enrollment in the plan?

SBP is an annuity.

Annuities are financial products that, at their core, provide longevity insurance--the risk of outliving your money. Life insurance, on the other hand, protects against the risk of premature death.

With an annuity, people can secure guaranteed income for life, or for a defined period of time, for themselves and/or their beneficiaries.

As is the case with any financial product, you should make the decision to purchase it based on how it will play into your overall financial strategy. This is why it is important to consult with a financial professional whom you trust prior to making your SBP enrollment decision.

At the core of this discussion are some key principles of financial strategy that we will discuss further as we go.

The more you understand these principles, the better equipped you will be to make your decision. First, let’s tackle opportunity costs. In order to do that, here are the assumptions:

- Retiree: 45 year old, healthy female

- Retirement gross monthly income: $5,000

- Full SBP coverage elected: Based on 100% of retirement gross monthly income

- SBP premiums based on SBP coverage elected: $325/month (6.5% of $5,000)

- Monthly benefit upon retiree’s death: $2,750 (55% of retiree income)

- Cost of Living Adjustment (COLA): 2%

- Beneficiary: Spouse only

- Amount earned after tax on savings: 4%

- Tax bracket: 22%

Opportunity costs in this case will be represented by what your premium dollars could have earned had they been saved instead of directed to SBP.

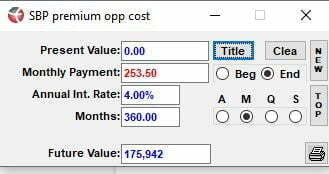

Using the assumptions above, a 30 year time horizon, and factoring in taxes, your premium dollars would be worth $175,942. Of that, $91,260 is the sum total of all your premium payments ($253.50 X 360), and $84,682 is the interest earned. 3

You may determine that this cost is worth it, but it’s no small chunk of change, and it’s important to measure. This is over $175,000 that you will never see again. And neither will your family unless you pass away. Additionally, $253.50 per month, or $3,042 per year, is no longer available to you for other opportunities, investments, or emergencies. You’ve lost control of these dollars, and you want to make sure that the benefit is worth it.

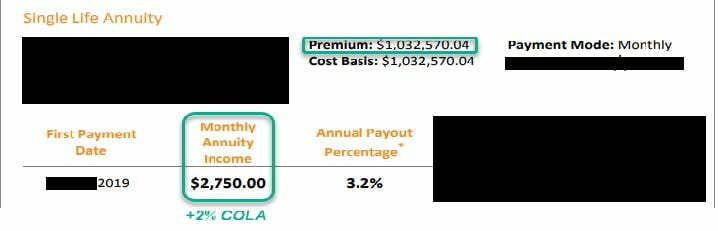

Say you do pass away the day after you retire. Your spouse will begin receiving a monthly benefit of $2,750, adjusted for cost of living, for the rest of his or her life.

What would it take to secure a monthly annuity with a 2% COLA for the rest of your spouse’s life?

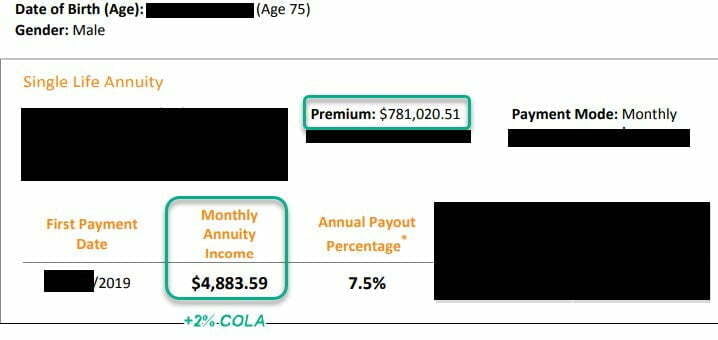

Assume the spouse is also 45 years old, and is a male living in FL. A single premium, fixed annuity, providing $2,750 per month with a 2% annual increase, would require a lump sum of about $1,032,570 at current interest rates (2019), insurance company dependent.

Maybe those premium payments are worth it after all, but compared to what?

If you want your spouse to continue receiving the same benefit SBP would have provided upon your death, there needs to be at least $1,032,570 left after tax.

That money needs to come from somewhere. It can come from savings and investments, or the sale of other assets. What happens if the stock and real estate markets crash at the moment your spouse needs the money?

Maybe you already have cash flowing assets, such as real estate, that will produce enough for your spouse; therefore, you might not care about replacing the pension income with additional funds.

For our purposes, assume that you do care about replacing the monthly income your spouse would receive from SBP, and you do not want to force a liquidation of your assets to make it happen.

Life insurance is one of the best tools to accomplish this objective. It uses actuarial science to determine the viability of the asset and has been a pillar of financial strategy for hundreds of years. Here is a quick rundown of life insurance basics.

There are two basic categories of life insurance: term and cash-value. Cash-value life insurance can be further broken down into:

- Whole life

- Universal, Variable life and associated hybrids

While all forms of life insurance provide a death benefit upon the insured’s death, we’re going to focus on term and whole life.

Term life insurance provides the most amount of death benefit for a given premium over a limited time. Premiums can be locked in for a given term, say 10, 20, or 30 years, after which time they increase. These policies can be convertible or non-convertible. Convertibility means the policy could be converted to a permanent policy in the future with no additional medical underwriting. Be sure to ask about this feature when speaking to your advisor.

Term policies do not provide any cash value growth, and the premiums are gone forever, once the period of coverage is complete. If you outlive the policy or stop paying premiums for any reason, coverage is cancelled and you do not recover any of the cash you paid into the policy. The same principle of opportunity costs applies to life insurance premiums.

Whole life insurance provides a death benefit for a given level of premium as long as the premiums are paid and the policy is kept in force. Premiums are guaranteed to never rise, but will be higher than a term policy with the same initial death benefit. Whole life also has a cash value component that is guaranteed to grow over time and is not correlated to market ups and downs.

Participating policies from mutual insurance companies have the opportunity to earn dividends each year which, when used to purchase paid-up additions (PUA), will increase both the cash value and death benefit. Dividends are not guaranteed to be paid each year, although many mutual companies have paid them every year for 100+ years through depressions and recessions.

Mutual companies differ from stock companies in that participating policy owners are the owners of the insurance company. Profits are shared by the policy owners in the form of dividends vice profit distributions going to stockholders.

SBP Alternative #1: Buy the cheapest term policy available.

Assumptions:

Risk class: Preferred, non-smoker

Policy type: Non-convertible, 30 year term policy

Female, age 45, good health

State of residence: FL

Initial death benefit: $1,032,570

Non-convertible monthly premium, years 1-30: $143.44

In this hypothetical case, the monthly premium for a non-convertible term policy is lower than the premiums required for SBP, even after tax ($143.44 versus $253.50.)

The opportunity cost on $143.44 over 30 years is $99,554, which is about $75,000 less than paying SBP premiums.

So, you would have 30 years of protection to replace SBP and $76,387 that you would not have had by paying SBP premiums..

The problem with a pure term insurance alternative to SBP is that you are still paying the opportunity cost associated with term premiums and losing control of that monthly cash flow.

On top of that, what happens after 30 years? If you die in the 31st year, there will be no death benefit and no continuation of monthly income through SBP.

If you don’t have some other sort of life insurance in place, your spouse will have to rely on whatever other assets have accumulated over the years to replace that income.

In this case, our retiree and spouse would both be 75 years old. Using the 2001 CSO Standard Life Expectancy tables, the male spouse can expect to live another 15 years. Most insurance companies don’t write level-term policies beyond 30 years from issue date, so this is a major factor.

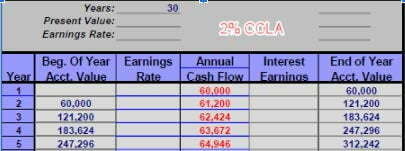

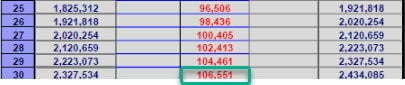

By age 75, our retiree’s pension has grown at 2% per year thanks to COLA. The new annual income is $106,551, making the SBP benefit $58,603.08, or $4,883.59/month.

At 2019 interest rates, an annuity on a 75 year old male providing a monthly income for life of $4,883.59/month with 2% annual COLA would require a lump sum of roughly $781,020, insurance company dependent.

While our retiree has been able to save the excess cash flow from not enrolling in SBP, she has only accumulated $76,387, a shortfall of about $705,000.In order to accumulate an extra $705,000 at 4% over 30 years, you would need to save an additional $1,015.78/month.

To recap SBP Alternative #1:

- Benefits:

- Potential to secure cheap term coverage

- Regain control of some cash flow to save and invest

- Options to cancel term policy at any time, unlike SBP premiums

- Actuarial science used to guarantee the insurance will pay out if terms are met

- Costs

- Still paying opportunity costs on term premium

- Do not have control of all your SBP cash flow

- Shortfall of assets after the level-term period is over

SBP Alternative #2: Integrate term with whole life insurance specially designed for higher cash value growth

Assumptions:

- DB goals:

- $1,032,570 immediately

- At least $781,020 remaining at age 75

- Monthly savings equals after tax cash flow from not enrolling in SBP plus additional savings to make up for age 75 and beyond shortfall.

- After tax cash flow from not paying into SBP: $253.50

- Additional cash flow to make up DB shortfall at age 75: $1,015.78

- Total monthly cash flow: $1,269.28

- Secure a whole life insurance policy with two important riders:

- Term insurance rider

- Enables an affordable increase in death benefit early on

- Paid-up additions rider (PUAR)

- Facilitates quicker cash value growth for access to funds if and when needed

- Term insurance rider

- Unless otherwise noted, cash values and death benefits assume current dividend scales which are not likely to remain the same throughout the life of a policy. Dividends are not guaranteed to be paid each year, although many mutual insurance companies have paid them every year for over 100 years at higher than current rates.

Here are the results:

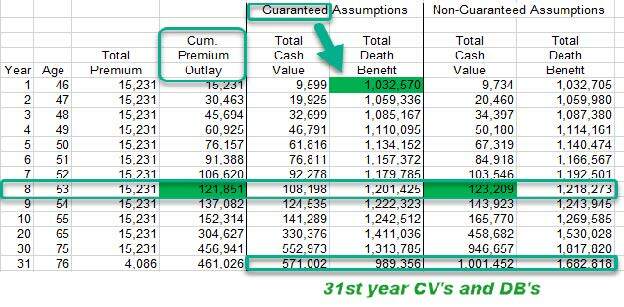

- Initial guaranteed death benefit: $1,032,570

- Premium: $1,269.28/month

- Cash value at the end of year one: $9,734 (over 63% of initial premium)

- Cash value exceeds premiums paid at the end of year eight: $123,209

- 31st year:

- Cumulative premiums paid: $461,026

- Cash value: $1,001,452

- Death benefit: $1,682,818

- All premiums paid have been recouped and your death benefit is sufficient to more than replace SBP after 30 years

- You maintain control of your cash flow as the growing cash values become available to leverage throughout your life

To recap SBP Alternative #2:

- Benefits:

- Control all of your cash flow

- Recoup all of your premiums at interest, minimizing opportunity costs

- Actuarial science guarantees the cash values and death benefits for life

- Thinking beyond just SBP premiums to create an integrated strategy

- Cash value grows tax free and is available for other investments/opportunities/

emergencies along the way-your money does multiple things at once - Dividends provide cash flow which increases cash value and death benefit and can be another source of income later in life

- Costs:

- Higher premium required to implement-need to plan for this as you transition

- Cumulative premiums exceed cash value in the early years-evaluate your cash flow needs for those first few years

When considering the strategy presented in alternative #2, the whole life policy you set up should be properly designed to focus on quicker cash value growth. An ordinary whole life policy will not build cash value as quickly as depicted in this example.

In summary, the decision to enroll in SBP should be part of an overall financial strategy that allows you to live the life you want and protect those you want to protect. Your situation will be different than the veteran who retired two months before you. Take time to think through your post-retirement objectives and implement the right strategy to accomplish them.

As you review your strategy, keep these principles in mind when choosing where to direct your cash flow for savings and investments:

- Cash flow-do the savings and investment vehicles you choose provide cash flow?

- Liquidity-are you able to access your funds quickly when desired?

- Control-do you control the underlying asset that your money is saved or invested in?

- Uncertainty-the degree of risk of the asset’s performance

- Interest rates-used to determine the economic outcome of the asset.

- Actuarial science-is actuarial science used to determine the viability of the asset?

- Opportunity costs-measure and minimize them.

Please reach out with any questions and share this with anyone you think would be interested.

Thanks!

Additional resources: