October 29, 2019 - By: Brandon Jenkins

Let’s take a look at two different strategies for financing the down payment of a typical buy and hold real estate investment. One strategy uses a policy loan from whole life insurance, the other uses cash from a bank account.

Investment opportunity assumptions:

● Single family rental

● Purchase price: $100,000

● 25% down payment: $25,000

● Monthly rental income: $1,300

● Monthly expenses: $1,000

● Positive monthly cash flow: $300

Strategy #1

Use a whole life insurance policy loan to cover the down payment. Pay back the loan with positive monthly cash flow. Analyze cash position after 15 years (180 months).

Policy assumptions:

● Cash value: $100,000

● IRR of cash value growth: 4%

● Policy loan interest rate: 5%

Using the $300 per month of positive cash flow from the investment, pay down the policy loan. This will take about 103 months.

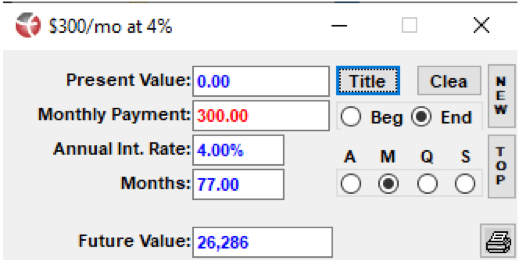

For the remaining 77 months, pay $300 per month back into your policy. At 4%, this would grow to $26,286.

All the while, your $100,000 of cash value was still growing tax free inside your policy. After 15 years, that $100,000 has turned into $182,030 for a gain of $82,030.

After 15 years, you have:

● paid off the policy loan so that all that cash value is available to leverage again

● $82,030 of cash value growth from allowing your policy cash value to remain untouched

● +$26,286 of additional cash value from investment cash flow contributions

● =after tax gain of $108,316

Strategy #2

Use cash from a savings account to cover the down payment. Pay back the savings account with positive monthly cash flow. Analyze cash position after 15 years (180 months).

Savings account assumptions:

● Starting balance: $100,000

● Interest on earnings: 1% pre-tax

● Tax bracket: 24%

Once you withdraw the $25,000, you’ll have $75,000 remaining in the account. At 1% earnings and a 24% tax bracket, this will grow to $84,020 after 15 years for a gain of $9,020. You will also put the $300/month or $3,600 per year back into savings. This will grow to $57,403 after 15 years.

After 15 years with strategy #2, you have:

● $9,020 of growth on the unused money in your savings account

● +$57,403 of savings growth from the investment cash flow

● =after tax gain of $66,423

Summary:

● After tax gain from Strategy #1 (whole life insurance): $108,316

● After tax gain from Strategy #2 (savings account): $66,423

● Advantage whole life

Other assumptions made:

● No changes in interest rates over 15 years. This would have a direct correlation to savings account earnings, policy cash values, and policy loan interest rates.

● No increase in rents or expenses which we would expect due to inflation.

● Dividends being paid on whole life insurance cash value at current rates. Dividends are not guaranteed; however, they have been paid consistently for well over 100 years by major mutual insurance companies.

The calculations above were derived from TruthConcepts financial calculators (www.truthconcepts.com) and are meant to serve as an example to help people understand the concept of how real estate investment returns might be enhanced using whole life insurance.

Always talk to your advisor when deciding whether or not to take a policy loan in order to determine how it will affect your long-term wealth strategy. While policy loans are a flexible and beneficial aspect of your life insurance policy, there are certain risks associated with them that could negatively impact your policy and overall financial picture.

If you have further questions, please feel free to contact us at: info@tieronelifeinsurance.com.